how to pay indiana state taxes quarterly

Claim a gambling loss on my Indiana return. If you file quarterly your payment schedule is as follows.

Dor Make Estimated Tax Payments Electronically

Find Indiana tax forms.

. Each quarter youll need to print a voucher attach a check or money order to. Paying State Income Tax in Indiana. Paying State Income Tax in West Virginia.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The state income tax rate is 323 and the sales tax rate. Simply take the total amount you paid and divide that by 4 to arrive at the amount you should be paying quarterly.

Paying State Income Tax in Arkansas. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Paying Quarterly Taxes by State.

However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. Take the renters deduction. Claim a gambling loss on my Indiana return.

Why did I receive a tax bill for underpaying my estimated taxes. QuickBooks Self-Employed calculates federal estimated quarterly taxes. Access INTIME at intimedoringov.

20 Annual taxes are due on the 31st of January if you file only once per year. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Have more time to file my taxes and I think I will owe the Department.

The rates will be. Payment is due by January 31 of the following year. Pay my tax bill in installments.

Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Line I This is your estimated tax installment payment. Some states also require estimated quarterly taxes.

Have more time to file my taxes and I think I will owe the Department. Where do I go for tax forms. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Up to 25 cash back Annually. You can find your amount due and pay online using the intimedoringov electronic payment system. One to the IRS and one to your state.

Paying State Income Tax in Delaware. 5 for overpayments 4 in the case of a corporation. Paying State Income Tax in Nebraska.

The tax bill is a penalty for not making proper estimated tax payments. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check. Line I This is your estimated tax installment payment.

Quarter 1 Jan-Mar due Apr. Go to EFT Registration in the INtax menu on the left side of the screen. 20 Quarter 2 Apr-Jun due Jul.

Know when I will receive my tax refund. This means you may need to make two estimated tax payments each quarter. Indiana also offers discounts for those who pay their taxes early.

Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. When paying quarterly taxes the easiest way to go about it is to pay 100 of the amount you paid in income tax from the previous year. Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel.

The option to make an estimated payment will appear in the Payment. As a self-employed person if you wish to avoid getting fined for underpayment of estimated taxes then youll want to file and pay by their due date. In the top right corner click on New to INTIME.

Complete and submit the online registration form. Paying State Income Tax in Oklahoma. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Take the renters deduction. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

WASHINGTON The Internal Revenue Service today announced that interest rates will increase for the calendar quarter beginning July 1 2022. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Although the registration form status states it is pending your bank information is stored and you may make an ACH debit payment immediately. Estimated payments may also be made online through Indianas INTIME website. To make a payment via INTIME.

25 for the portion of a corporate overpayment exceeding 10000. You should also know the amount due. Revenue Department of 19 Articles.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. These are state and county taxes that are withheld from your employees wages. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

The tax year for 2021 is nearly over but if you still want to know the dates you may go by the following deadlines. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. INtax only remains available to file and pay the following tax obligations until July 8 2022. 20 Quarter 3 Jul-Sept due Oct.

This is not an automatic withdrawal. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. If you did make estimated tax payments either they were not paid on time or you did not pay.

If you have employees working at your business youll need to collect withholding taxes. Registration for withholding tax is necessary if the business has. Find Indiana tax forms.

Paying State Income Tax in Wisconsin. 20 Quarter 4 Oct-Dec due Jan. Paying State Income Tax in Montana.

Know when I will receive my tax refund. Where can I get information about the 125 Automatic Taxpayer Refund. Pay my tax bill in installments.

IR-2022-107 May 20 2022. If you need to make quarterly payments you can calculate the amount you need to pay with TaxActs Tax Calculator and print out quarterly payment vouchers.

Indiana Ifta Fuel Tax Requirements

Year End Focus Filing And Paying Taxes

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Indiana Dept Of Revenue Inrevenue Twitter

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

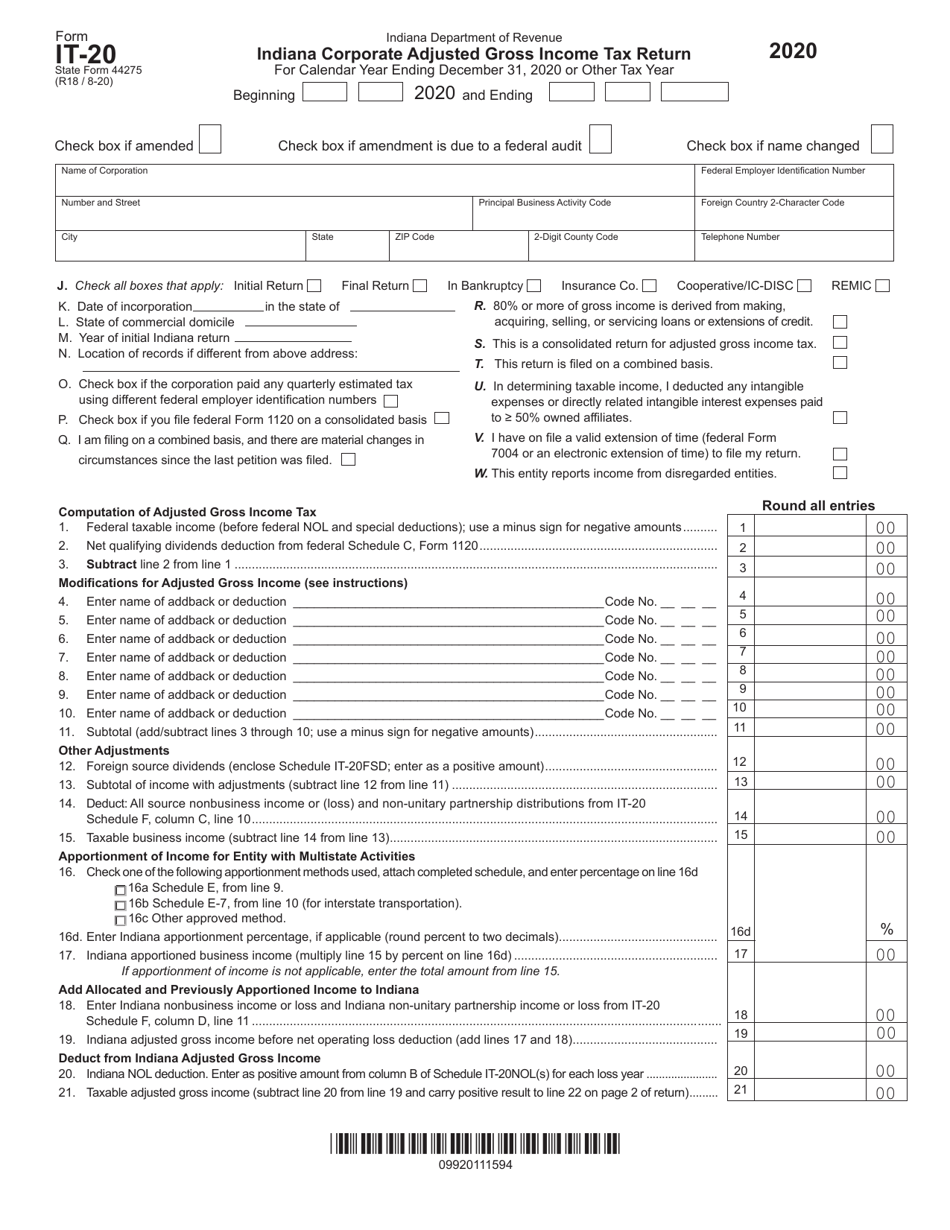

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

Indiana Dept Of Revenue Inrevenue Twitter

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Dor Keep An Eye Out For Estimated Tax Payments

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago